Financing Information

Maintaining a High Level of Cash Flow from Operating Activities

Dassault Systèmes Capital Allocation

We focus our uses of cash on:

- Repayment of financial debt;

- Share repurchases to minimize share dilution from stock-based employee performance programs;

- Capital returns to shareholders in the form of dividends;

- Select acquisitions undertaken consistent with our Mission, Strategy and Addressable Market expansion objectives.

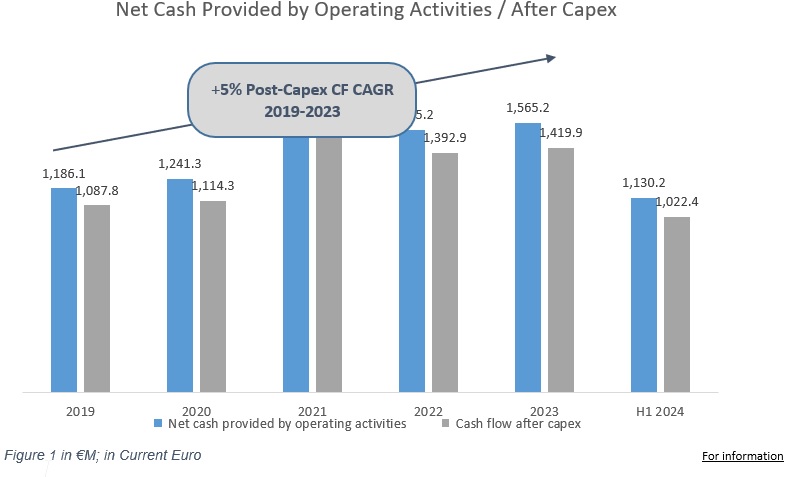

For the half-year ended June 30th, 2024, cash flow from operations totalled €1.13 billion, up 10% year over year thanks to the increase in net income adjusted for non-cash items and positive cash tax effects during the semester. Cash from operations was principally used for treasury shares buy-back and employee shareholding plan net of proceeds from stock options exercise for €272 million, and cash dividend payments for €303 million.

Maintaining Significant Financial Flexibility with a High Level of Liquidity

The evolution of our cash and net financial position reflects the acquisition of Medidata Solutions, Inc. on October 28, 2019. The cash purchase price was paid with Bonds in the amount of €3.0 billion, a term loan, drawn in Euro and US dollar, in an aggregate amount of €1.0 billion, and with cash on hand, in Euro and US dollar, in an aggregate amount of €1.1 billion.

Our net financial position at June 30th, 2024 totaled €1.04 billion, an increase of €0.46 billion, compared to €0.58 billion for the year ended December 31, 2023, reflecting cash, cash equivalents and short-term investments of €4.03 billion and debt related to borrowings of €3.00 billion at June 30, 2024.

Our adjusted net debt /IFRS EBITDAO ratio stood at 0.0x at December 31, 2023, compared to 0.4x at December 31, 2022, based on an adjusted net debt including the lease liabilities as reported under IFRS 16 of €33 million and an IFRS EBITDAO for the year ended December 31, 2023 of €2,040 million.

Corporate Rating

On November 17th, 2023, Standard & Poors Global Ratings re-affirmed their “A” rating with a stable outlook for Dassault Systèmes SE and its long term credit.

|

Agency |

Date |

Long term |

Outlook |

Short term |

Business risk profile |

| S&P | November 17th, 2023 | A | Stable | - | Strong |

| S&P | April 17th, 2023 | A | Stable | - | Strong |

| S&P | April 26th, 2022 | A | Stable | -- | Strong |

|

S&P |

August 27th, 2019 |

A- |

Stable |

-- |

Strong |

N.B : for the latest S&P report on the company please register on https://www.spglobal.com/ratings/en/products-benefits/products/ratings360

Bond Issue Program

We have used the net proceeds of the issue of our inaugural senior unsecured Eurobonds, amounting to approximately €3.65 billion, for general corporate purposes, including the financing in part of the acquisition of Medidata Solutions, Inc. and the refinancing of a €650 million bank loan that was to mature in 2022. We have repaid the first tranche for €900 million, which matured on September 16, 2022.

|

Bond |

Date of issue |

Maturity Date |

Volume (in €m) |

Coupon (Payable Annually) |

|

2024 |

Sept. 16, 2019 |

Sept. 16, 2024 |

700 |

0% |

|

2026 |

Sept. 16, 2019 |

Sept. 16, 2026 |

900 |

0.125% |

|

2029 |

Sept. 16, 2019 |

Sept. 16, 2029 |

1,150 |

0.375% |

Borrowings

|

As of June 30, 2024 |

Payments due by period |

|||

|

in million euros |

Total |

Less than 1 year |

1-5 years |

5-10 years |

|

Bonds |

2,741,6 |

699,9 |

897,6 |

1,144,1 |

|

Term loan facilities in euro currency |

0,9 |

0,2 |

0,7 |

|

| Commercial Papers | 248,8 | 248,8 | ||

|

Accrued interests |

4,4 |

4,4 |

||

|

TOTAL |

2,995,5 |

953,2 |

893,3 |

1,144,1 |

In July 2022, the Group launched a program of commercial papers (Negotiable EUropean Commercial Paper - NEU CP) with a maximum outstanding amount, authorized by the Board, of €750.0 million.

During the first half of 2024, the Group issued €910.0 million with a maximum maturity of three months and reimbursed €910.0 million under this program. As of June 30, 2024, the commercial papers total €248.8 million.

Our financing facilities do not contain covenants linked to changes in the Group’s rating. A lower credit rating would result in an increase (capped) in the margins applicable to the credit facilities; symmetrically, a higher rating would lead to a decrease in the applicable margin (with a floor).

Line of credit

We secured a financing commitment in the form of a revolving line of credit of €750 million for a period of 5 years from October 28, 2019. In May 2020 and May 2021, we exercised our option to extend its term for one year respectively, bringing the new termination date to October 2026. As of June 30th, 2024, the line of credit was not drawn down.